Last updated on July 14th, 2024 at 05:53 pm

Government Budget and the Economy

Government Budget – Meaning, Objectives And Components.

Meaning

A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Just like your household budget, the government also has a budget of its income and expenditure. In the beginning of every year, the government presents before the Lok Sabha an estimate of its receipts and expenditure for the coming financial year.

The government plans a budget according to its expenditure and then tries to raise funds to meet the proposed expenditure.

Government earns money broadly from taxes, fees and fines, interest on loans given to states and dividends by public sector enterprises.

Government spends mainly on: Securing and providing goods and services to citizens, On law and order and Internal security, defence, staff salaries, etc.

In India there is a constitutional requirement to present a budget before Parliament for the ensuing financial year. The financial (fiscal) year starts on April 1 and ends on March 31 of next year.

Objectives

General objectives of a government budget are as under:

Objectives

- To promote rapid and balanced economic growth to improve the living standard of the people.

- To eradicate poverty and unemployment by creating employment opportunities and providing maximum social benefits to the poor

- To reduce inequalities of income and wealth, the government can influence distribution of income through levying taxes and granting subsidies.

- To reallocate resources so as to achieve social and economic objectives. e.g., public sanitation, rural electrification, education, health, etc.

- To bring economic and price stability, by controlling fluctuations in general price level through taxes, subsidies and expenditure.

- To finance and manage public enterprises like railways, power generation and water lines etc.

Components And Classification

There are two main components of the Government Budget.

Revenue Receipts

Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Revenue receipts are further classified as tax revenue and non-tax revenue.

- Tax Revenue

Tax revenue is the income received from different taxes and other duties levied by the government. It is a major source of public revenue.

Taxes are of two types of tax], viz., Direct Taxes and indirect taxes

Direct taxes are taxes that an individual pays directly to the government, such as income tax, land tax, and personal property tax. Such direct taxes are based on the ability of the taxpayer to pay, higher their capability of paying is, the higher their taxes are.

Indirect taxes are those taxes which are levied on goods and services and affect the income of a person through their consumption expenditure. E.g. Custom duties, sales tax, services tax, excise duties, etc.

- Non-Tax Revenue

Apart from taxes, governments also receive revenue from other non-tax sources.

Fees : Fees paid for registration of property, births, deaths, etc.

Fines and penalties : Fines and penalties for not following (violating) the rules and regulations.

Profits from public sector enterprises : Many enterprises are owned and managed by the government. It is an important source of non-tax revenue. For example in India, the Indian Railways, Oil and Natural Gas Commission, Air India, etc.

Gifts and grants : Gifts and grants are received by the government. Citizens of the country, foreign governments and international organisations like the UNICEF, UNESCO, etc. donate during times of natural calamities.

Special assessment duty : It is a type of levy imposed on the people for getting some special benefit. For example, in a particular locality, if roads are improved, property prices will rise.

Capital Receipts

Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Some more examples:

- Loans raised by the government from the public through the sale of bonds and securities. They are called market loans.

- Borrowings by government from RBI and other financial institutions through the sale of Treasury bills.

- Loans and aids received from foreign countries and other international Organisations like International Monetary Fund (IMF), World Bank, etc.

- Receipts from small saving schemes like the National saving scheme, Provident fund, etc.

- Recoveries of loans granted to state and union territory governments and other parties.

Click Below To Learn Other Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Present

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current challenges facing Indian Economy

- Unit 8: Development Experience of India

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024

2. 15+ Economics Sample Paper 2024

3. 15+ Business Studies Sample Paper 2024

4. 12+ Physical Education Sample Paper 2024 With Solution

5. 15+ Physics Sample Paper 2024 With Solution

6. 15+ Chemistry Sample Paper 2024 With Solution

7. 15+ Biology Sample Paper 2024 With Solution

8. 15+ English Sample Paper 2024

9. 15+ History Sample Paper 2024

10. 15+ Geography Sample Paper 2024

11. 15+ Maths Sample Paper 2024

Classification Of Capital Expenditure And Revenue Expenditure

Capital Expenditure

Any projected expenditure which is incurred for creating asset for a long life is capital expenditure.

Therefore, expenditure on land, machines, equipment, irrigation projects, oil exploration and expenditure by way of investment in long term physical or financial assets are capital expenditure.

The following are the examples of capital expenditure :

Expenditure incurred for :

- Acquisition of fixed tangible assets such as land, building, machinery, furniture, motor vehicle etc. Improvement or extension of fixed assets such as increasing the seating capacity of a theatre.

- Bring the fixed assets to the place of their use and expenditure incurred on their installation or erection such as freight on fixed assets, wages paid for purchase of intangible assets such as goodwill, patent rights, and trademarks, copyright, etc.

- Reconditioning of old fixed assets such as expenditure incurred on repairing or overhealing of secondhand machinery.

- Major repairs and replacement of plants which increase the efficiency of the plant.

Rules for Determining Capital Expenditure.

An expenditure is capital expenditure:

- When it is incurred for acquiring a long term asset (having a useful life of more than one year) for use in the business to earn revenue and not meant for sale.

- When it is incurred to put an asset into working condition. For example, the transportation and installation charges are added to the cost of machine, the legal charges like registration and stamp duty is added to the cost of land and building, etc.

- When it incurred for putting an old asset into working condition is treated as capital expenditure and added to the cost of the asset.

- When it is incurred to increase the earning capacity of a business is treated as capital expenditure. For example, expenditure incurred for shifting the factory to convenient site is a capital expenditure.

Revenue Expenditure

When an expenditure is made for running the business with a view to produce the profits is revenue expenditure. Such expenditure benefits the current period only.

It is incurred to maintain the existing earning capacity of the business. Administrative expenses and selling and distribution expenses are examples of revenue expenditure.

Rules for Determining Revenue Expenditure.

An expenditure incurred:

- For the purpose of acquiring goods purchased for resale, consumable items, etc. Other direct expenses like production and purchase of goods such as wages, power, freight etc. are revenue expenditure.

- For maintaining fixed assets in working order e.g. amount spent on repairs and renewals

- Depreciation on fixed assets

- On office and administrative and selling and distribution departments in the normal course of business. These include salaries, rent, telephone expenses, electricity, postage, advertisement, travelling expenses, commission to salesmen.

- On non-operating expenses and losses are revenue expenditures. For example, interest on loan taken after commencement of commercial production, loss on sale of a long term asset, loss by theft, loss by fire are revenue expenditures.

- By an enterprise to discharge itself from recurring liability is of revenue nature. For example, a lump sum amount paid to a pensioner by the employer is revenue expenditure.

- For protecting the business is a revenue expenditure. For example, the amount spent on propaganda campaign to oppose the threatened nationalisation of industry is of revenue nature.

- To maintain the existing efficiency or the earning capacity is of revenue type.

Distinction Between Capital Expenditure and Revenue Expenditure:

| Capital Expenditure | Revenue Expenditure |

|---|---|

| Enduring for more than one accounting period. | Enduring for one accounting period only. |

| Relates to the acquisition of fixed asset | Relates to the acquisition of stock-in-trade. |

| Usually of non-recurring nature | Usually of recurring nature. |

| Helps to increase the earning capacity of the business or to reduce the operating cost. | Is incurred to maintain the existing earning capacity of the business. |

| Not matched against capital receipts. | Matched against revenue receipts for income determination |

| May be incurred even before the commencement of business. | Incurred only after the commencement of business |

Measures Of Government Deficit

A Deficit is the budgetary situation where expenditure is higher than the revenue. When in a set budget government expenditure exceeds the income amount it is government deficit.

This deficit indicates the financial health of the economy. To reduce this deficit between expenditures and income, the government cut back certain expenditures and also increased revenue-generating activities.

This expenditure revenue gap may be financed by either printing of currency or through borrowing.

Nowadays most governments in the world are having deficit budgets and these deficits are often financed through borrowing.

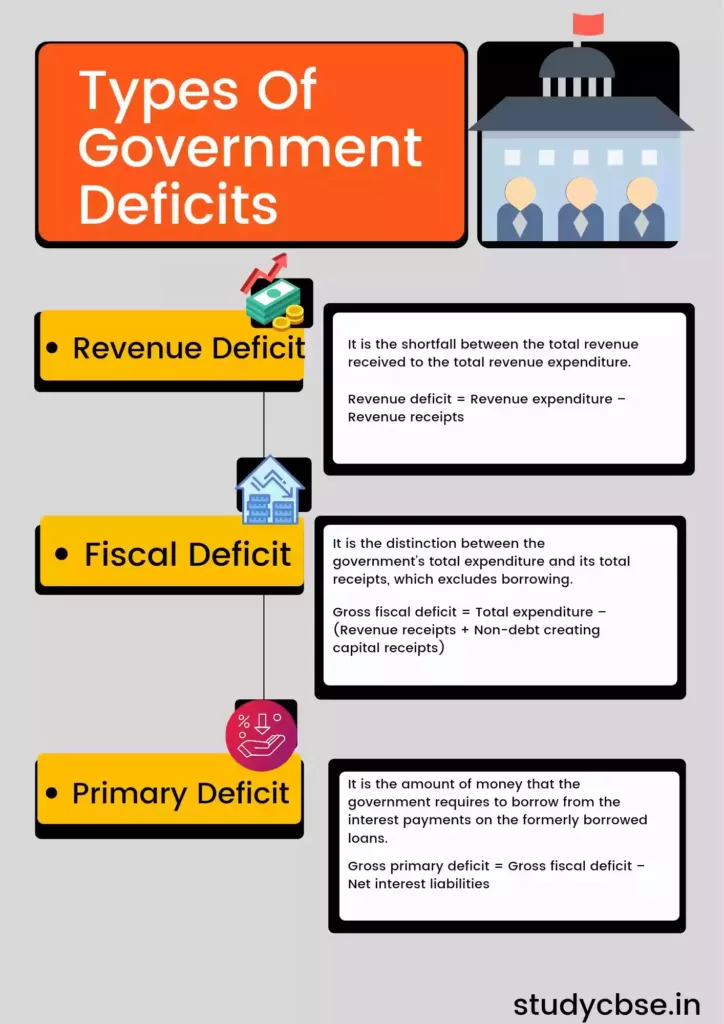

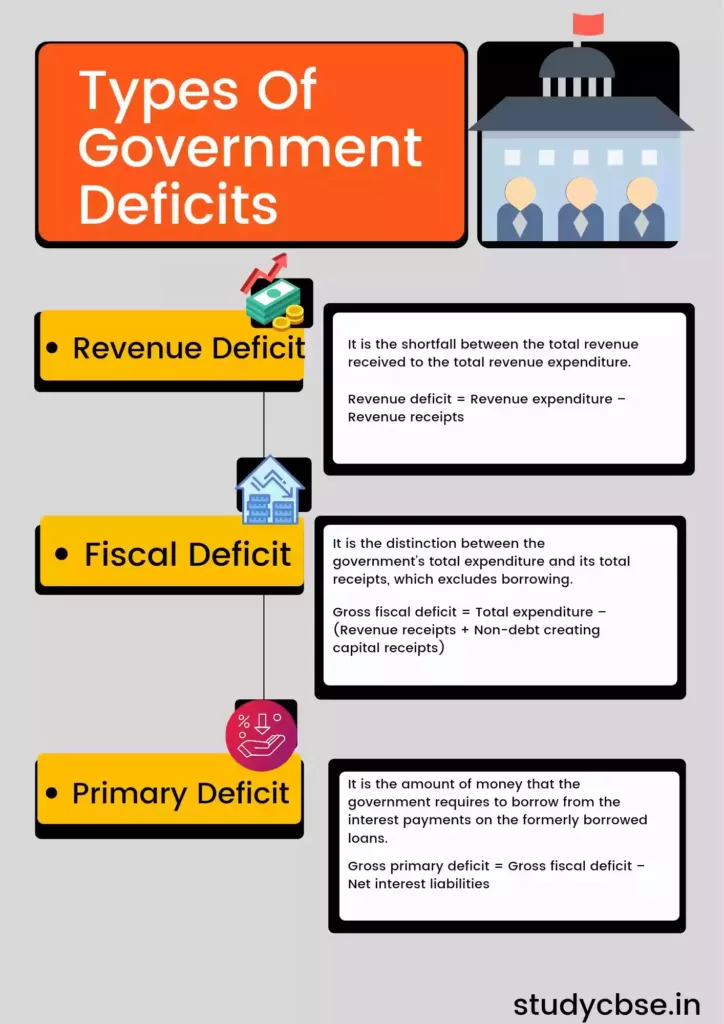

Types Of Government Deficits

- Revenue Deficit

- Fiscal Deficit

- Primary Deficit

Revenue Deficit

It is the surplus of the government’s revenue expenditure over the revenue receipts.

It is the shortfall between the total revenue received to the total revenue expenditure.

Revenue deficit = Revenue expenditure – Revenue receipts

Revenue deficit only incorporates current income and current expenses. A high degree of deficit symbolises that the government should reduce its expenses.

The government may raise its revenue receipts by raising income tax. Disinvestment and selling off assets is another corrective measure to minimise a revenue deficit.

Fiscal deficit

It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Gross fiscal deficit = Total expenditure – (Revenue receipts + Non-debt creating capital receipts)

A fiscal deficit has to be financed by borrowing. Thus, it includes the total borrowing necessities of the government from all the possible sources. From the financing part.

A greater deficit implies more borrowing by the government and the extent of the deficit indicates the amount of expense for which the money is borrowed.

Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

Fiscal deficit indicates the amount of money that the government will need to borrow during the financial year.

A disadvantage or implication of fiscal deficit is it may lead to a debt trap or it may lead to unnecessary and wasteful expenditure by the government which may lead to uncontrolled inflation.

Primary deficit

It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

The aim of quantifying the primary deficit is to concentrate on current fiscal imbalances.

Gross primary deficit = Gross fiscal deficit – Net interest liabilities

Net interest liabilities comprise interest payments – interest receipts by the government on the net domestic lending.

Difference between Fiscal Deficit and Revenue Deficit

Measures to Reduce Government Deficit

- Increased emphasis on tax-based revenues and appropriate measures to reduce tax evasion.

- Disinvestment should be done where assets are not being used effectively

- Reduction in subsidies by the government will also help reduce the deficit.

- Try to avoid unplanned expenditures.

- Borrowing from domestic sources.

- Borrowing from external sources.

- A broadened tax base

An uncontrolled government deficit may lead to decline in the financial health of the economy. The agenda of the government should be to plan the revenues and expenditures in such a way that the economy moves towards a balanced budget situation.

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024

2. 15+ Economics Sample Paper 2024

3. 15+ Business Studies Sample Paper 2024

4. 12+ Physical Education Sample Paper 2024 With Solution

5. 15+ Physics Sample Paper 2024 With Solution

6. 15+ Chemistry Sample Paper 2024 With Solution

7. 15+ Biology Sample Paper 2024 With Solution

8. 15+ English Sample Paper 2024

9. 15+ History Sample Paper 2024

10. 15+ Geography Sample Paper 2024

11. 15+ Maths Sample Paper 2024

Click Below To Learn Other Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Present

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current challenges facing Indian Economy

- Unit 8: Development Experience of India

Frequently Asked Questions

Q1. What is Government Budget?

Answer: A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Q2. What is revenue receipts?

Answer: Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Q3. What is Capital receipts?

Answer: Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Q4. What is revenue deficit?

Answer: It is the surplus of the government’s revenue expenditure over the revenue receipts. It is the shortfall between the total revenue received to the total revenue expenditure.

Q5. What is Fiscal deficit?

Answer: It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Q6. What is primary deficit?

Answer: It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

Government Budget and the Economy Unit 4 CBSE, class 12 Economics notes. This cbse Economics class 12 notes has a brief explanation of every topic that NCERT syllabus has.

You will also get ncert solutions, cbse class 12 Economics sample paper, cbse Economics class 12 previous year paper.

Final Words

From the above article you must have learnt about ncert cbse class 12 Economics notes of unit 4 Government Budget and the Economy. We hope that this crisp and latest Economics class 12 notes will definitely help you in your exam.