Last updated on July 14th, 2024 at 05:27 pm

Money And Banking MCQ

Below are some of the very important NCERT MCQ Questions of Money And Banking Class 12 Economics Chapter 2 with Answers. These Money And Banking MCQ have been prepared by expert teachers and subject experts based on the latest syllabus and pattern of term 1 and term 2. We have given these Money And Banking MCQ Class 12 Economics Questions with Answers to help students understand the concept.

MCQ Questions for Class 12 Economics Chapter 2 are very important for the latest CBSE term 1 and term 2 pattern. These MCQs are very important for students who want to score high in CBSE Board.

We have put together these NCERT Questions of Money And Banking MCQ for Class 12 Economics Chapter 2 with Answers for the practice on a regular basis to score high in exams. Refer to these MCQs Questions with Answers here along with a detailed explanation.

MCQ

1. Supply of money refers to ___________

(a) currency held by the public

(b) currency held by Reserve Bank of India (RBI)

(c) currency held by the public and demand deposits with commercial banks

(d) currency held in the government

2. _________ is the main source of money supply in an economy

(a) Central Bank

(b) Commercial banks

(c) Both (a) and (b)

(d) Government

3. Demand deposit include:

4. Identify the correctly matched pair of the items in column A to that of column B

(a) saving account deposit and fixed deposit

(b) saving account deposit and current account deposits

(c) current account deposit and fixed deposits

(d) all types of deposits

| Column A | Column B |

| 1. Supply of money | a. Money in circulation at a point |

| 2. Stock of money | b. Supply of money considered over the period |

| 3. Flow of money | c. Money held by the public and the bank today |

| 4. Reserve money | d. Supply of money studied at a point of time |

(a) 1- a

(b) 2- b

(c) 3- c

(d) 4- d

5. Who regulate money supply in India

(a) Government of India

(b) Reserve Bank of India

(c) Commercial banks

(d) Planning Commission

6. Which of the following statements is true

(a) M1 is the most liquid measure of money supply

(b) M2 is the most liquid measure of money supply

(c) M3 is the most liquid measure of money supply

(d) All the statement are true

7. Identify the correctly matched pair of the items in column A to that of column B

| Column A | Column B |

| 1. Money | a. Supply of money |

| 2. Commercial bank | b. Store of value |

| 3. Central Bank | c. Credit control |

| 4. M4 | d. Circulation of money |

(a) 1- a

(b) 2- b

(c) 3- c

(d) 4- d

8. Which of the following statements is/are correct ?

(a) ₹1 note is issued by the RBI

(b) Coins are issued by the government of India

(c) Both statements are true

(d) Both statements are false

9. Match and find the correct pair.

| Column A | Column B |

| 1. Money supply | a. Total stock in circulation |

| 2. Money creation | b. Function of Central Bank |

| 3. Money stock | c. Function of the commercial bank |

| 4. Money demand | d. Money in the bank |

(a) 1- a

(b) 2- b

(c) 3- c

(d) 4- d

10. Which of the following statements is false?

(a) Demand deposits are not legal tender

(b) Currency notes issued are not legal

(c) Term deposits are not legal tender

(d) Wheat is not legal tender

11. Money supply includes ____________

(a) All deposit in banks

(b) Only demand deposit in banks

(c) Only time deposits in banks

(d) Currency with the banks

12. Which of the following statement is true?

(a) All financial Institutions are banking institutions

(b) RBI has the complete authority to issue currency note

(c) The Government of India issues currency notes

(d) Banking institutions issue currency notes

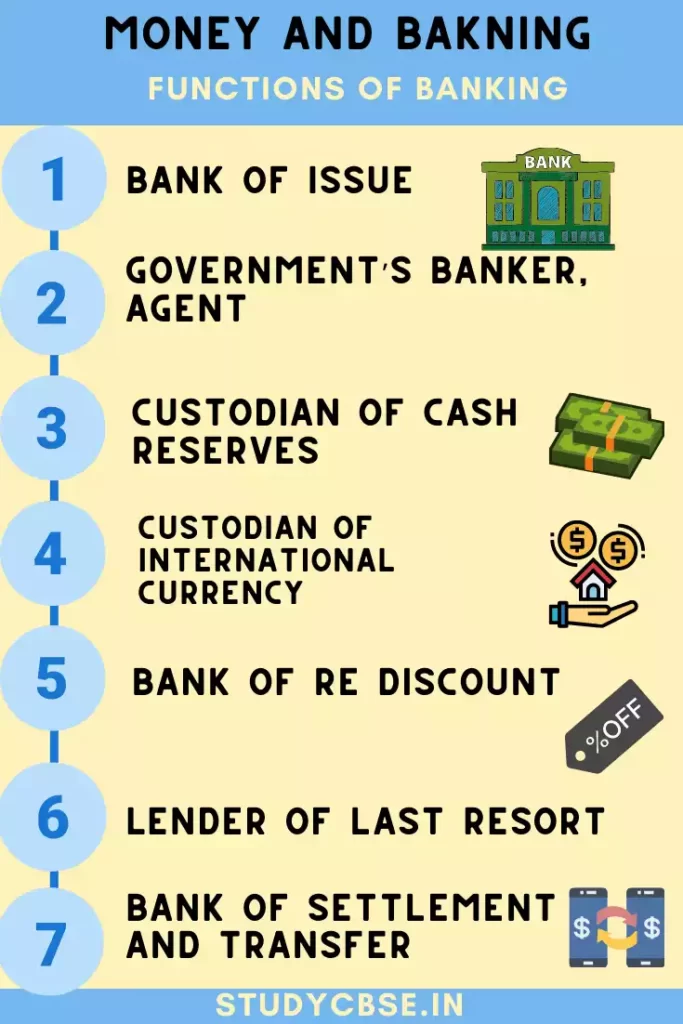

13. Which of the following is not the function of the central bank?

(a) Banking facilities to government

(b) Banking facilities to public

(c) Lending to government

(d) Lending to commercial banks

14. In the present COVID-19 situation, many economists have raised their concern that Indian economy may have to face a deflationary situation due to reduced economic activities in the country.

Suppose you are a member of the high powered committee constituted by the Reserve Bank of India. You have suggested that as the supervisor of commercial banks ____________ (restriction/release) of the money supply be insured by the Reserve Bank of India

(a) Restriction

(b) Release

(c) Either (a) or (b)

(d) Neither (a) nor (b)

15. Match and identify the correct pair.

| Column A | Column B |

| 1. Issue of new currency notes | a. Government of India |

| 2. Bankers to the government | b. State Bank of India |

| 3. Controller of credit seller | c. Reserve Bank of India |

| 4. SLR | d. Development Bank |

(a) 1 -a

(b) 2 – b

(c) 3 – c

(d) 4 – d

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024

2. 15+ Economics Sample Paper 2024

3. 15+ Business Studies Sample Paper 2024

4. 12+ Physical Education Sample Paper 2024 With Solution

5. 15+ Physics Sample Paper 2024 With Solution

6. 15+ Chemistry Sample Paper 2024 With Solution

7. 15+ Biology Sample Paper 2024 With Solution

8. 15+ English Sample Paper 2024

9. 15+ History Sample Paper 2024

10. 15+ Geography Sample Paper 2024

11. 15+ Maths Sample Paper 2024

Click Below To Learn Economics All Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Unit 4: Government Budget and the Economy

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current Challenges Facing Indian Economy

- Unit 8: Development Experience of India

MCQ Answers

1. (c)

2. (c)

3. (b)

Demand deposits includes saving account deposits and current account deposits because these are the liquid and and be used immediately to purchase goods and services

4. (a)

Money supply is the total stock of money circulating in the economy at a particular point of time including currency other liquid instruments

5. (b)

RBI is the top Monetary Authority in the country who print currency and regulations money supply through the monetary policy.

6. (a)

M1 includes all forms of assets that are easily exchangeable as payment for goods and services. It consists of coin and currency in circulation and demand deposits as payment for goods and services.

7. (c)

The Central Bank regulates the volume and use of credit by using quantitative and qualitative tools, i.e. monetary policy. Instruments of monetary policy are bank rate repo rate reverse repo rate cash reserve ratio.

8. (b)

Coins in India are issued by the government of India. It is the sole responsibility of the Government of India to mint coins of all denominations.

9. (a)

Money supply is the total stock of money in circulation held by public at a given point of time

10. (b)

Legal tender is type of money that the court of law need to see as a satisfactory payment of any financial Dept. In India the authenticated legal tender of the Reserve Bank of India consists of coins and notes

11. (b)

Money supply is the total stock of money circulating in the economy at a particular point of time including currency and other liquid instruments

12. (b)

The central bank undertakes this function of being a monopolist by issuing currency to maintain uniformity of currency across Nation and to control money supply process at a centralised level.

13. (b)

Commercial banks deals with public directly by accepting and lending deposit

14. (b)

RBI should release money as it will increase money supply in the economy and the inturn will increase production activities.

15. (c)

By controlling credit the central bank can exercise an effective control over economic activities and mobilize it in the described direction. Central Bank regulate the volume and use of credit by using quantitative and qualitative tools.

Assertion-Reason Based MCQ

Code

- Both assertion and reason are true and reason is the correct explanation of assertion.

- Both assertion and reason are true but reason is not the correct explanation of assertion.

- Assertion is true but reason is false.

- Assertion is false but reason is true.

1. Assertion: M1 is the least liquid measure of money supply

Reason: M1 includes the currency in circulation demand deposits with the bank and other deposits with the RBI

2. Assertion: M4 is the least liquid measure of money supply

Reason: M4 is inclusive of all the money supply include in M3 as well as the total deposits with the post office

3. Assertion: Demand deposits are not legal tender

Reason: They are with the bank, so only can be used as a legal tender when cheques are issued for the transfer

4. Assertion: Money is what money does

Reason: Money facilitates exchange of goods and services

Assertions-Reason Based MCQ Answers

1. (4)

M1 is the most liquid measure of money supply as it includes all forms of assets that are easily exchangeable as payment for goods and services. It includes coins and currency in circulation, demand deposits, Travellers cheque and other checkable deposits

2. (1)

3. (3)

Legal tender money is that form of money that has a legal sanction by the government behind it. Checkable demand deposits are not legal tender because a person can legally refuse to accept payment through checkable demand deposits

4. (1)

Money is defined as anything that acts as a medium of exchange

Case-Study Based MCQ

1. Read the following passage and answer accordingly.

In a 40 minute long speech Prime Minister Narendra Modi announced the demonetisation of existing notes of ₹ 500 and ₹ 1000 during a televised address on Tuesday evening. Modi announced that the notes of ₹500 and ₹ 1000 will not be legal tender from midnight tonight and this will be just worthless piece of paper. PM also asked people to join the mahayojana against the ills of corruption.

(i) Under whose purview does the issue of new currency fall in?

(a) Reserve Bank of India

(b) Central Government of India

(c) State Government

(d) All the above

(ii) Which two currency denominations were demonetized

(a) ₹ 100 and ₹ 500

(b) ₹ 500 and ₹ 2000

(c) ₹ 1000 and ₹ 2000

(d) ₹ 500 and ₹ 1000

(iii) _________ is issued by the government of India .

(a) Coins

(b) ₹ 500 notes

(c) ₹ 1000 notes

(d) All of these

(iv) ₹1 currency note is issued by ________

(a) Finance ministry

(b) RBI

(c) Niti Aayog

(d) None of these

2. Read the following passage and answer accordingly.

On March 5, 2020, the Reserve Bank of India (RBI) imposed a 30-day moratorium on YES Bank, superseded the private-sector lender’s board, and appointed Prashant Kumar, who was serving as chief financial officer and deputy managing director at State Bank of India (SBI), as an administrator.

Under the terms of the moratorium, deposit withdrawals were capped at Rs 50,000 per person. The central bank proposed a reconstruction scheme under which SBI might take a maximum of 49% stake in the restructured capital of the bank.

Analysts believed the new management of YES Bank, headed by former Deutsche Bank India head Ravneet Gill, who joined the bank in early 2019, could turn around the ship. Gill, however, has struggled to do so.

The banks loan book on March 31, 2014, was ₹ 55,633 crore, and its deposits were ₹74,192 crore. Since then, the loan book has grown to nearly four times as much, at 2.25 billion as on September 30, 2019.

While deposit growth failed to keep pace and increased at less than three times to ₹ 2.10 trillion. The bank’s asset quality also worsened and it came under regulator RBI’s scanner.

YES Bank has a substantial exposure to several troubled borrowers, including the Anil Ambani-led Reliance group, DHFL and IL&FS. The tipping point came when one of the banks independent directors, Uttam Prakash Agarwal, resigned from the board in January 2020 citing governance issues.

(i) Which of the following function has been performed by the RBI in the above case study?

(a) Banker to the Commercial Bank, here YES Bank

(b) Supervision and Regulation of the Commercial Bank, here YES Bank

(c) Controlling credit creation in the economy.

(d) Managerial function

(ii) Under the moratorium, the deposit withdrawal was capped at

(a) ₹ 10000

(b) ₹ 5,OOO

(c) ₹ 30000

(d) ₹ 60,000

(iii)Read the following statements.

Assertion: YES Bank put into the check of the RBI.

Reason: The loan book has grown to nearly four times and deposit failed to grow.

Select the correct alternative from the following:

(a)Both Assertion and Reason are true, and Reason is the correct explanation of Assertion .

(b) Both Assertion and Reason are true, but Reason is not the correct explanation of Assertion.

(c) Assertion is true, but Reason is false.

(d) Assertion is false, but Reason is true.

(iv) What another role does the RBI play for the Commercial Banks like YES Bank?

(a) Advisor to the Bank

(b) Banker to the Bank

(c) Controls the credit created by the bank

(d) All of the above

Case-Study Based MCQ Answers

1.

(i) (a)

The central bank plays the role of the sole note issuing authority in the economy

(ii) (d)

(iii) (a)

It is the sole responsibility of the Government of India to mint coins of all denominations.

(iv) (a)

The one rupee note and coins are issued by Ministry of Finance and it bears the signature of Finance secretary.

2.

(i) (b)

(ii) (d)

(iii) (a)

The loan book has grown to nearly four times as much, at ₹2.25 trillion as on September 30, 2019. While deposit growth failed to keep pace and increased at less than three times to ₹2.10 trillion

(iv) (d)

Central Bank, as the Banker’s bank, accepts deposits from the commercial banks and offers them loans as and when required. As the agent and advisor to the government, it manages public debt on behalf of the government and also advises on policy matters. Central bank control credit creation to remove causes responsible for instability in price fluctuations which inturn are related to the supply of money

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024

2. 15+ Economics Sample Paper 2024

3. 15+ Business Studies Sample Paper 2024

4. 12+ Physical Education Sample Paper 2024 With Solution

5. 15+ Physics Sample Paper 2024 With Solution

6. 15+ Chemistry Sample Paper 2024 With Solution

7. 15+ Biology Sample Paper 2024 With Solution

8. 15+ English Sample Paper 2024

9. 15+ History Sample Paper 2024

10. 15+ Geography Sample Paper 2024

11. 15+ Maths Sample Paper 2024

Click Below To Learn Economics All Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Unit 4: Government Budget and the Economy

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current Challenges Facing Indian Economy

- Unit 8: Development Experience of India

Final Words

From the above article, you have practiced Money And Banking MCQ of class 12 Economics Chapter 2. We hope that the above-mentioned MCQs for term 1 of chapter 2 Money And Banking will surely help you in your exam.

If you have any doubts or queries regarding Money And Banking MCQ (Multiple Choice Questions) with Answers, feel free to reach us and we will get back to you as early as possible.